Succession Planning FAQs and Additional Resources

As a business leader, you have questions about maximizing your company’s value and succession planning. We have answers tailored to your healthcare business.

What does succession planning mean?

Succession planning is an ongoing business strategy for passing on leadership roles, including company owner, to family members, employees, or a group of employees. Such planning helps ensure that your business continues to run smoothly after you move on to new opportunities or retire.

It also helps you preserve personal and family wealth.

Why do businesses do succession planning?

Savvy small business owners and large corporations alike know the value of succession planning. Developing a succession plan can help:

- Your company survives unforeseen circumstances, such as the sudden departure or death of someone in a leadership role.

- Encourage you to think long-term, and reevaluate your goals.

- It can save you money. Training employees and promoting from within can be cheaper than luring someone away from another company.

- Succession planning can keep your staff motivated. It shows them the company is thinking about the future.

Why do businesses do exit planning?

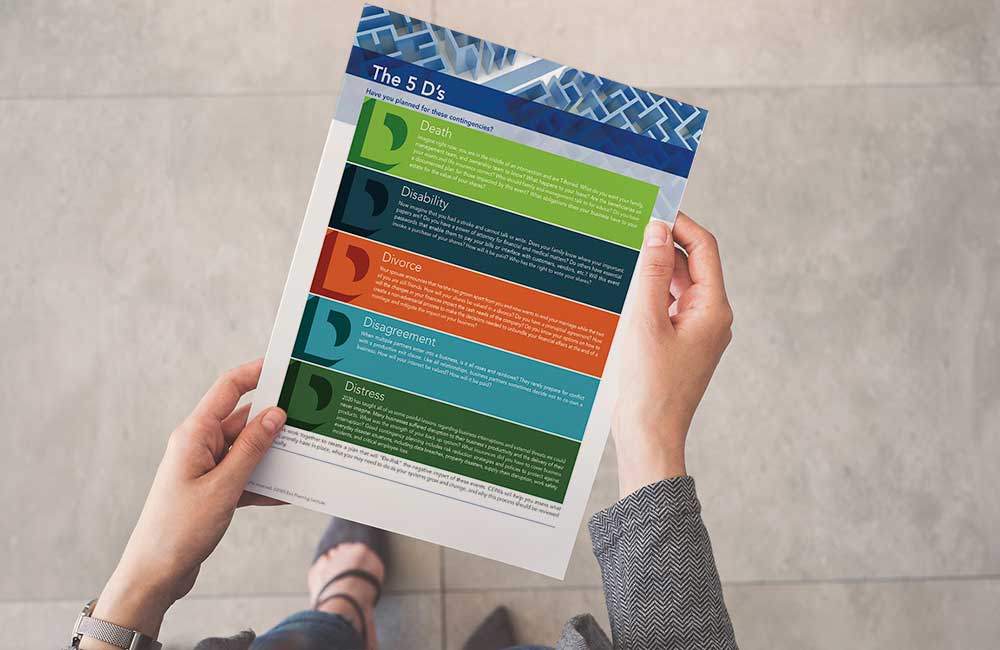

Get prepared for the 5 D's

A lot of businesses are forced to sell and are never prepared be it because of Divorce, Death, Disagreement, Disability, and/or Distress. The companies are never worth what you think they are when you are ready to sell. Exit planning is a business strategy that makes the timing of your exit irrelevant.

Value Acceleration Major Steps:

- Recast Income Statement and Balance Sheet

- Complete financial analysis

- Pull benchmarking data such as industry performance and recent trade multiples

- Complete an Enterprise Value Assessment (EVA) which scores the business attractiveness and the owner’s personal, financial, and business readiness

- Correlate the interview scores with the business valuation and financial analysis

- Deliverable:

– A specific and qualified list of personal, financial, and business strengths and weaknesses

– Correlated and used to justify present value and potential value

– To establish a monetary value with regard to what value enhancement is worth - A prioritized Action Plan is created both for Personal / Financial Actions as well as Business Actions

- Which will be implemented in 90-Day “Sprints” (Interval Training) Using the 3 Gates Discover | Prepare | Decide

What’s the difference between succession planning and exit planning?

The two go hand in hand.

In a nutshell, succession planning involves identifying, training, and eventually transferring the leadership or management of your company to another person or team of people. Exit planning focuses on identifying and executing the transfer strategy of your company and transferring ownership to another person, team, or entity.

Is your business ready for sale?

Are you ready for the happiest day of your life?

An Exit Strategy is a Business Strategy

Find out how to exit your business without regrets

Resources & Important Information

Explore our blog for insightful articles, personal reflections and ideas that inspire action on the topics you care about.

I am raw html block.

Click edit button to change this html